By Michael Obianyo

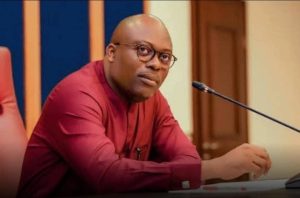

With the rise in digital adoption across Nigeria’s growing fintech sector, distrust persists as a large segment of the population still prefers cash and relies on physical interactions before trusting financial systems. For Eniola Temitope Taiwo, founder and CEO of Smartsave, this trust gap is not a barrier but the starting point. Her Smartsave hybrid savings platform has demonstrated that true financial inclusion thrives when technology meets people at their comfort level.

Speaking to Taiwo, She told Sparklight News that the model was built around people’s lifestyles. She observed that many Nigerians want to save, but need reassurance before using a digital tool, and thus, the idea of a hybrid savings platform was born. Based on the observation, she developed a physical-digital model to build trust. This involves trained account officers who meet users in person to collect deposits, which are then recorded on the company’s internal dashboard. The customer’s digital wallet is updated in real-time, allowing them to see their balance immediately; this boosts their confidence.

When users watch their money appear instantly, the system becomes familiar rather than intimidating. Many who start offline later transition to managing their accounts independently on the app or web platform,” she said.

Taiwo noted that the growth of Smartsave is linked to intentional design decisions. “The system synchronises agent entries with user accounts within seconds. Balances are easy to view, and features are presented in a manner that aligns with how cash-first savers already organise their finances.”

Smartsave has also seen strong results from its Student Ambassador Initiative, which promotes peer-led digital literacy on campuses. The combined effect is a smoother shift from physical deposits to digital use, with about 40 percent of offline customers eventually adopting the full digital experience.

The growth of Smartsave, according to Taiwo, is driven by trust, not advertising. Smartsave has been able to process over N200 million in savings and bill-payment transactions as a result of the user confidence rather than aggressive marketing.“Most new users join through referrals, with each customer bringing in several others. Retention is high due to consistent system reliability, and the Ambassador program continues to expand the user base in communities where traditional digital on-boarding rarely succeeds,” she stated.

Taiwo believes the model demonstrates that inclusion can be commercially sustainable when products mirror the realities of their audience. “People don’t resist technology, they resist uncertainty. When the process is clear and predictable, adoption becomes natural,” she said.

Her background in data analysis shapes Smartsave’s operations. “Every feature—from instant wallet updates to the notification system—was informed by questions users asked in the early stages, and field feedback continues to play a major role in each product iteration.”

For her, the numbers explain what is happening, but conversations with users explain why. This blend of analytical insight and on-the-ground feedback has become central to the company’s evolution.

As Smartsave scales, its model challenges the idea that financial inclusion must start exclusively with digital interfaces. Taiwo’s work suggests the reverse: meaningful inclusion begins with familiarity, trust, and respect for existing habits. Technology then becomes a supportive tool rather than a replacement.

Smartsave’s steady rise offers a case study for emerging-market fintechs trying to reach communities that remain cautious about digital tools. By blending human interaction with dependable digital infrastructure, the company is charting a path that makes the transition into the digital economy more accessible for millions.