By Our Reporter

Standard Chartered Bank has advised Nigerians not to hoard dollars at this point due to the volatility in the foreign exchange market.

The lender gave this advice during its global market outlook on Friday.

Speaking at the event, the Head of Financial Markets & Rates & Credit Trading, West Africa, Ayodeji Adelagun, said that given the unstable naira, that was the time to buy only as many dollars as required for use per time.

Adelagun said, “This is not the time to speculate, it’s not time to stockpile. It’s time to get only what you need. If you need to pay for something, buy what you need and move on.”

He pointed out that the volatility seen with the naira was as a result of attempts of the Central Bank of Nigeria to mop up excess liquidity.

“The central bank is trying to mop up as much liquidity as possible to reduce the volume of cash chasing FX. The moment we will begin to get to normalcy and FX liquidity is available, and then we will begin to see the effects of some of these policies right now. So, everything is a derivative of FX management.

“In getting to the point where liquidity should improve, foreign portfolio investors are likely to get interested in Nigeria and there is a chance that we can raise money through the Eurobond.”

He added that the biggest worry for foreign portfolio investors was the lack of ease of entry and exit.

“And that is because the price in the market does not necessarily tell us where the currency should be traded. Recently, we saw the FMDQ begin to publish prices that are fairly reflective of where the market rates are. What this does is to open the door for foreign portfolio investors to bring in their money because they are likely to have a market rate.

“It is not going to happen as quickly as we want it to happen, but this is a good development, in which case there is a likelihood that we’ll begin to see a few of them coming. The moment the market continues to adjust and it is perceived to be positive, it begins to open the door for us to go to a Eurobond issuance,” he added.

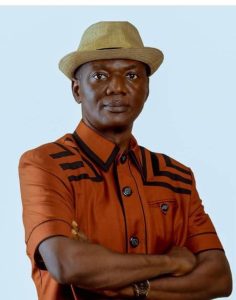

In his address at the event, the Chairman of the bank, Foluso Phillips, pointed out that the way Nigerians were reacting to the forex issue would create unnecessary pressure and panic.

“My own message is let’s watch carefully. I know that the aim of the central bank, as far as other financial matters are concerned, is to try and resolve these issues.

“We must have a very positive attitude. As far as what is going on in the country, it is obvious that we are all pretty concerned. We are all a bit jittery, we invest and we’ve worked hard and we need to have our assets protected. And we need to be monitoring what’s happening in the system so that we don’t get our finger burnt, so to speak,” he said.

Likening the scenario to building a house, the bank chairman pointed out that the measures being put in place by the apex bank would require time to settle and trigger the process it was meant to do before Nigerians begin to see the effect.

He declared, “… a lot of things are time bound. When I was building my house, somebody mentioned to me that when you put in a concrete slab, you put the concrete but you got to give it time to settle. You can’t rush it. You wait before you put up the next floor. And it’s almost exactly the message I get that a lot of things have been put in place.’